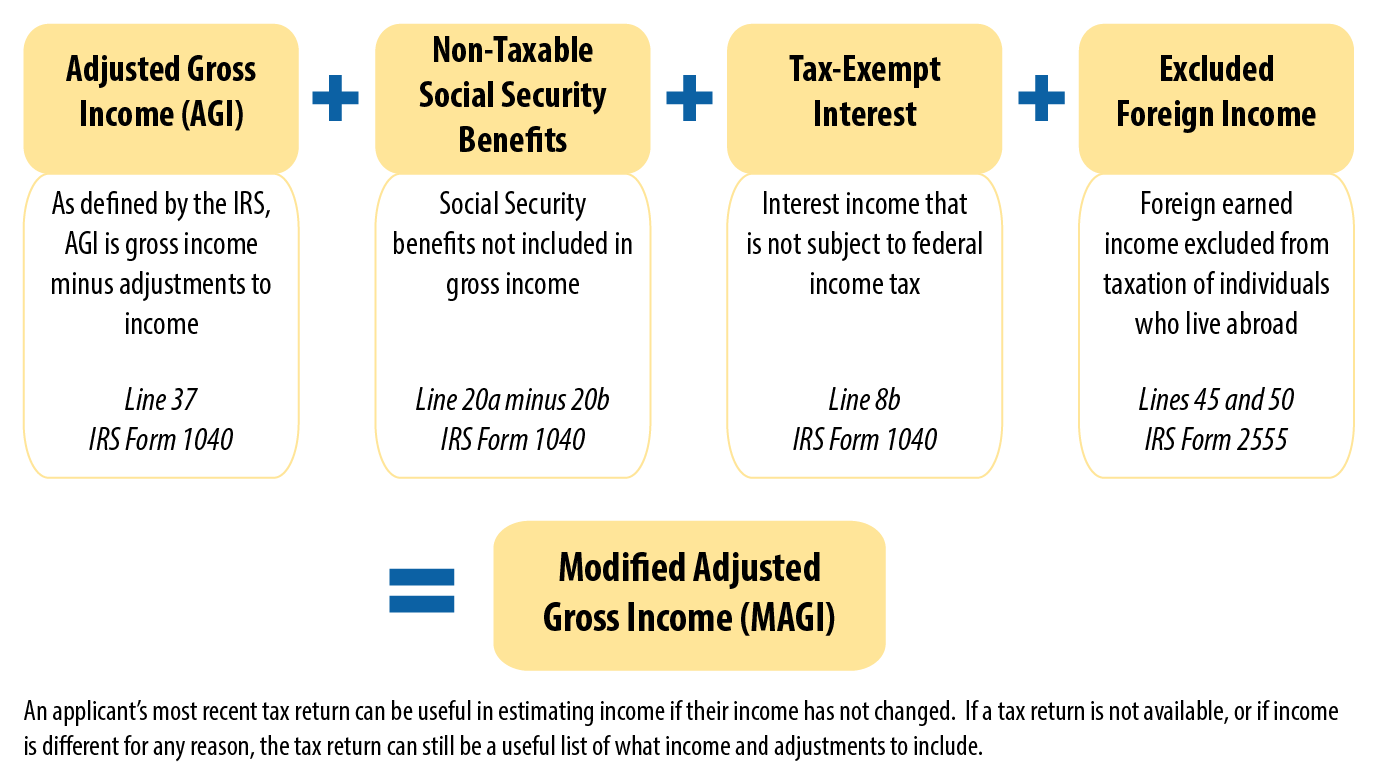

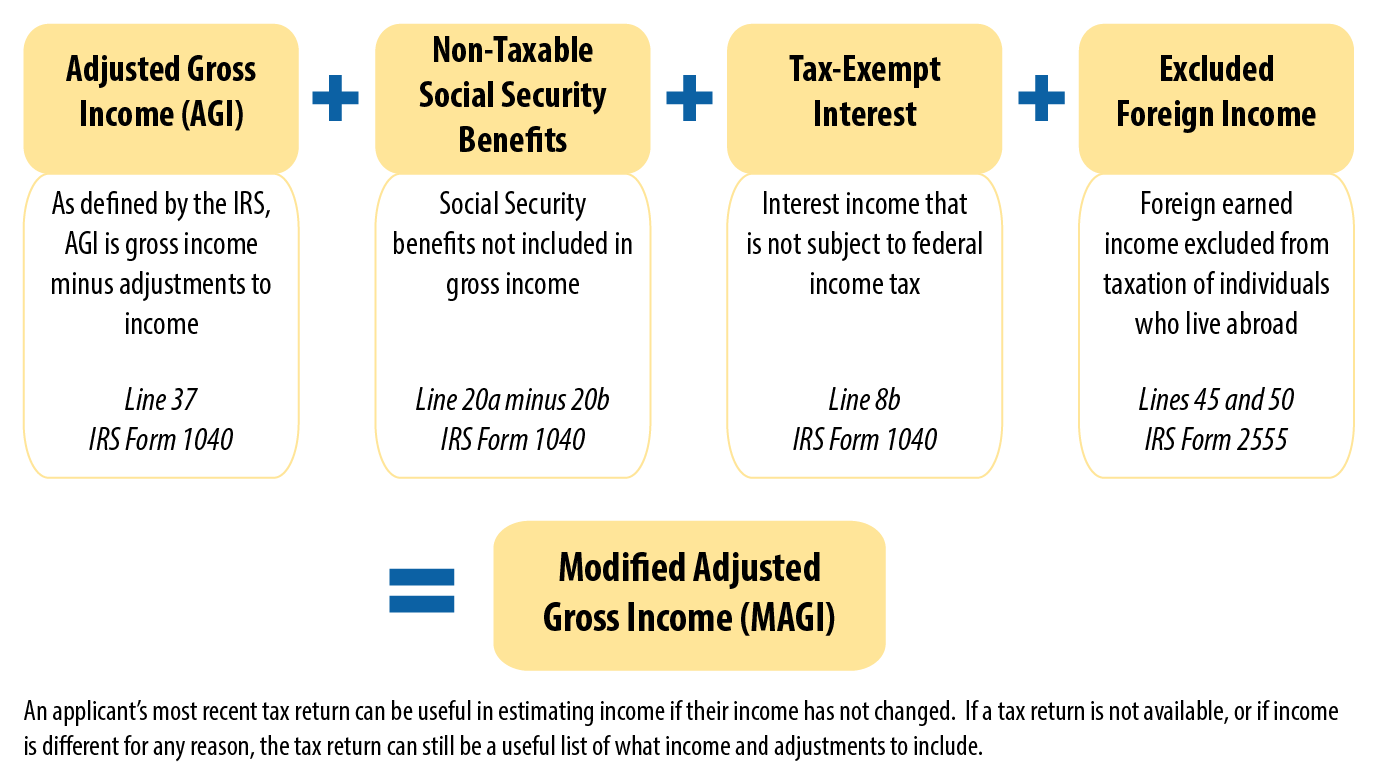

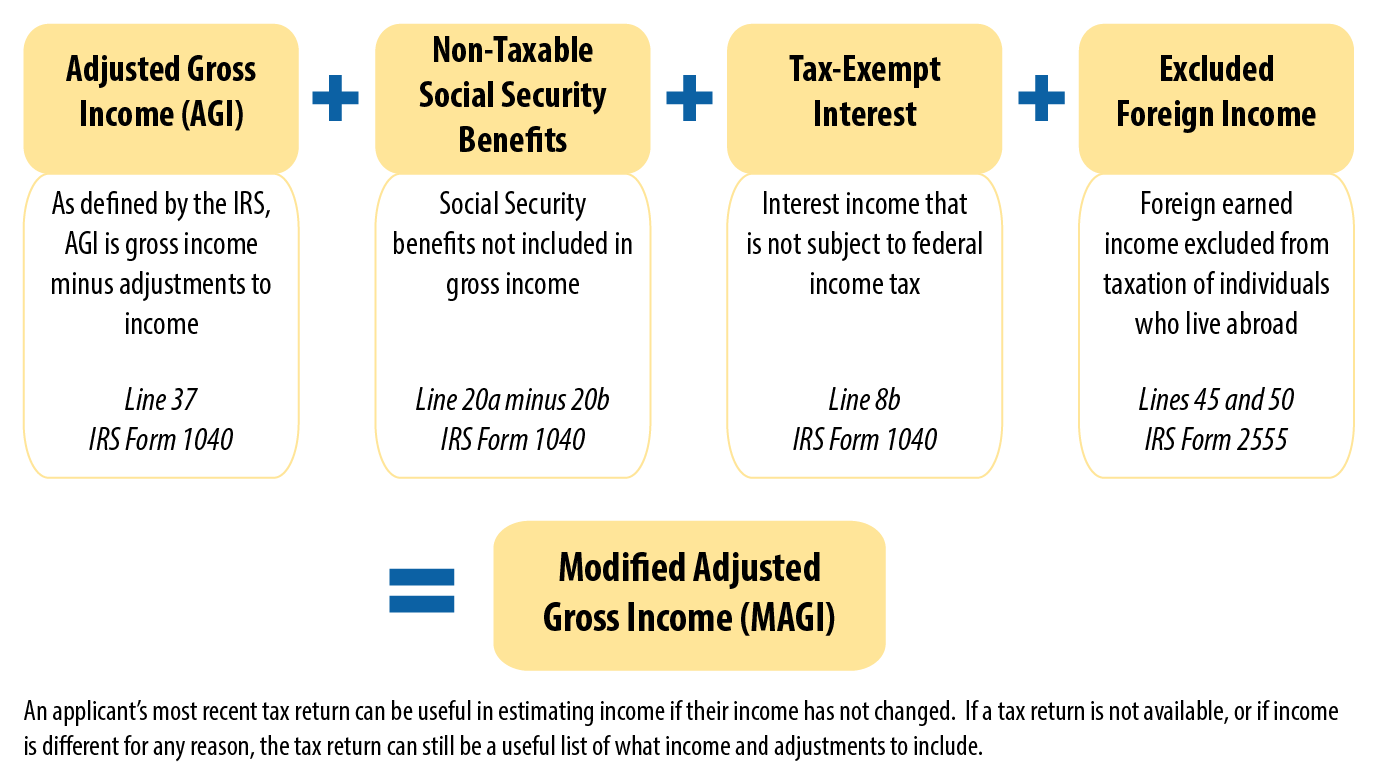

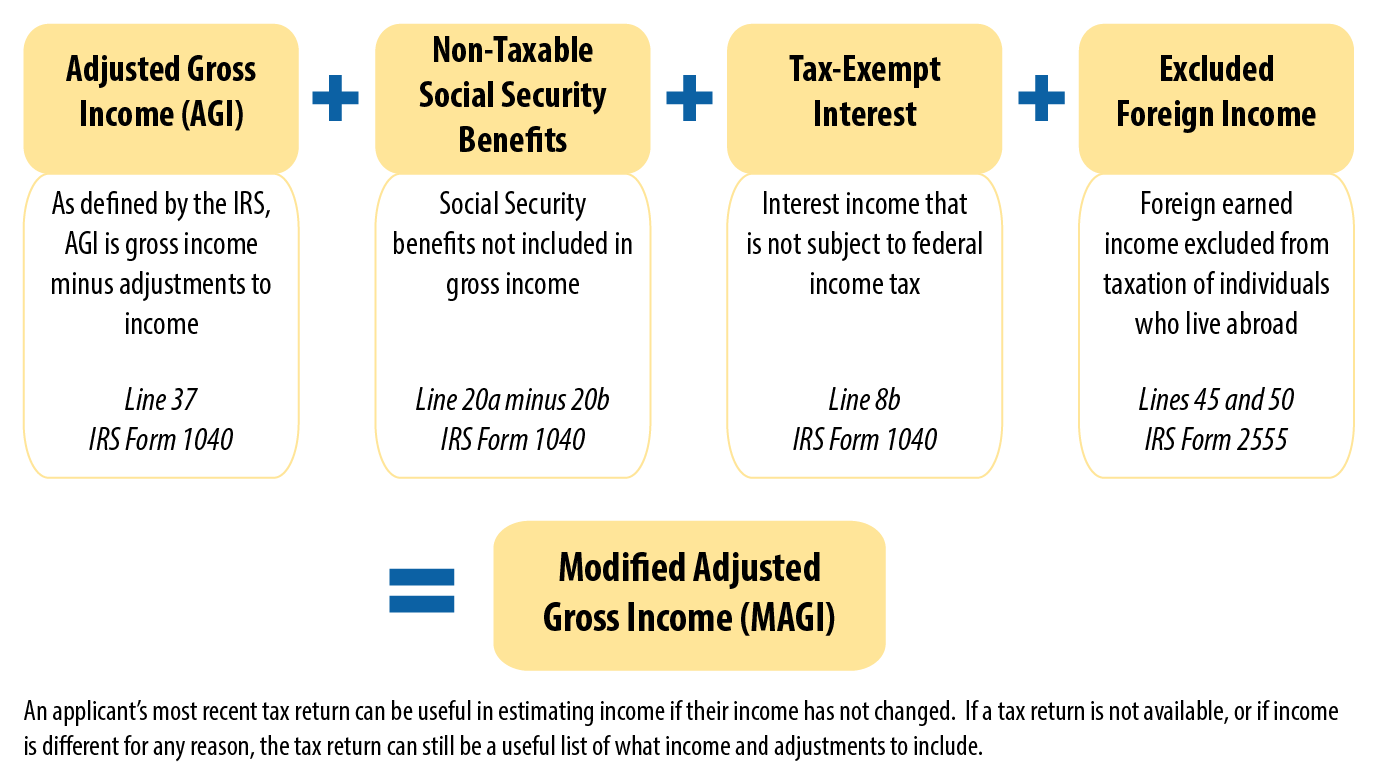

Modified Adjusted Gross Income (MAGI) is Gross Income (GI) Adjusted for deductions (AGI) and then Modified by adding some deductions back in (MAGI). On this page, we cover MAGI as it applies to Medicaid and the Marketplace. The way you calculate MAGI for other tax purposes can differ slightly so see specific IRS instructions for other types.

MAGI is used to determine ObamaCare’s cost assistance and to claim and adjust tax credits on the Premium Tax Credit Form 8962. You can find more details on Modified AGI from the IRS here or you can see the form 8962 instructions for calculating Modified AGI for the tax credit (TIP: use command find on those documents to find what you are looking for; make sure to check out the worksheet in the 8962 instructions, for example “Worksheet 1-1. Taxpayer’s Modified AGI”). Please note that some specifics like page number may change each year, always check out the latest official forms.

UPDATE 2019: This page is meant to give a general overview. Please be aware that some specifics may change each year (line numbers, specific dollar amounts, what can be deducted, what income types are added back in, etc). We will always do our best to keep the information up to date. However, you should make sure to double check the official documents when it comes time to calculate your income for tax purposes.

We go pretty in-depth on MAGI and related terms, so we’ve included a cheat sheet using information from berkeley.edu to help you understand MAGI better (we also updated this cheat sheet for 2019 since there have been a few major changes since Berkeley published). In general, for most people who got tax credits, MAGI will be the same as AGI. AGI can be found on your 1040 line 7.

For tax purposes, follow the instructions on the 8962 worksheet found further down this page. The MAGI cheat sheet is helpful (especially for estimating cost assistance), but following the specific worksheet instructions will ensure you are adjusting your tax credits properly for tax season.

Information for the table above is from berkeley.edu.

MAGI? Modified AGI is your Modified (M) Adjusted (A) Gross Income (GI). You can find a requirement to report “Modified AGI” (MAGI) on Form 8962, Premium Tax Credit (PTC). The form’s instructions include steps for calculating Modified AGI.

Marketplace Eligibility is based on annual MAGI while Medicaid / CHIP is based on current monthly income. In many states, Medicaid/CHIP can be based on projected MAGI for the rest of the calendar year. If you are applying for Medicaid make sure to check with your state Marketplace or state Medicaid office. You can see a breakdown of monthly Federal Poverty Guidelines here.

Below is a handy table from healthreformbeyondthebasics.org that shows how Medicaid MAGI has changed in states that expanded Medicaid. See a list of income counted as MAGI for Medicaid from the same site (we present the information below, but it helps to have both lists on hand for verification).

Taxable and non-taxable Social Security income is counted toward MAGI for ObamaCare and affects tax credits and Medicaid eligibility, but only if a person has to file taxes.

Social Security Income includes disability payments (SSD and SSDI), pension, retirement benefits, and survivor benefits, but does not include supplemental security income (SSI). (Line 20a minus 20b on a Form 1040). In general, everything except for SSI counts toward MAGI for ObamaCare and Medicaid.

ObamaCare counts Modified Adjusted Gross Income (MAGI) of the head of household and spouse and the Adjusted Gross Income (AGI) of tax dependents. However, if a tax dependent doesn’t have to file taxes due to falling below the tax filing threshold, then their non-taxable social security income doesn’t count toward MAGI. This is because nontaxable social security income doesn’t count toward the tax filing limit. So if the only income of a tax dependent is nontaxable social security income, they may want to consider not filing to maximize cost assistance eligibility limits of the household. Or conversely, they may want to file to ensure the family qualifies for a Marketplace plan with cost assistance rather than Medicaid.

TIP: Survivor benefits can have some complicated tax rules. As a rule of thumb, if the benefits are taxable, they count toward MAGI for the marketplace and Medicaid, and if they aren’t they do not. With that said, Social Security income specifically is counted toward MAGI for ObamaCare and thus affects tax credits and Medicaid eligibility if a person has to file taxes. Social Security Income includes disability payments (SSD and SSDI), pension, retirement benefits, and survivor benefits, but does not include supplemental security income (SSI). (Line 20a minus 20b on a Form 1040). In general, everything except for SSI counts toward MAGI for ObamaCare and Medicaid…. however, it can be the case that a child doesn’t have enough other taxable income for it to count (see specific rules for children here: https://www.irs.gov/faqs/social-security-income/survivors-benefits/survivors-benefits). If you need assistance in figuring out what you qualify for, you can always contact the marketplace or your local social security office for help!

What is SSI? SSI is not a Social Security benefit. SSI actually stands for “supplementary security income.” SSI is a government program that provides stipends to low-income people who are either aged (65 or older), blind, or disabled. Even though its administered by the Social Security Administration, SSI is funded from the U.S. Treasury general funds, not the Social Security trust fund. In short, you don’t count SSI for ObamaCare or Medicaid eligibility or cost assistance.

HSA’s, retirement accounts like 401ks, and other tax advantaged investment vehicles can be a smart choice for lowering GI, AGI, and MAGI. Specifically for ObamaCare, HSA’s really stand out.

Not only can you lower your MAGI with an HSA (it lowers AGI and isn’t added back to MAGI), you can also accumulate interest tax-free, and spend money on out-of-pocket medical (and dental and vision) tax-free. The healthcare savings really add up!

You’ll have to have a high-deductible health plan and be aware of your income to decide whether funding an HSA works for you. Don’t go under subsidy floors by over funding an HSA if your income is low; do go under subsidy ceilings like 400% FPL if your income is high. See our page on HSAs and our page on retirement accounts to learn how to lower your MAGI for ObamaCare tax credits and cost-sharing reduction subsidies.

NOTE: Not all things that lower GI lower MAGI, some tax vehicles have particular requirements and risks. Please see the details of what is added back into MAGI on this page, and consider getting professional tax help.

Below are common types of income and what is counted. The list is from HealthCare.Gov and is based on the full list from the IRS. We re-list much of this below (and it’s related to the Medicaid list above), but this is for those who want the official list.

| Income type | Included? | Notes |

|---|---|---|

| Federal Taxable Wages (from your job) | Yes | If your pay stub lists “federal taxable wages,” use that. If not, use “gross income” and subtract the amounts your employer takes out of your pay for child care, health insurance, and retirement plans. |

| Tips | Yes | |

| Self-employment income | Yes | Include “net self-employment income” you expect — what you’ll make from your business minus business expenses. Note:You’ll be asked to describe the type of work you do. If you have farming or fishing income, enter it as either “farming or fishing” income or “self-employment,” but not both. |

| Unemployment compensation | Yes | |

| Social Security | Yes | Include both taxable and non-taxable Social Security income. Enter the full amount before any deductions. |

| Social Security Disability Income (SSDI) | Yes | But do not include Supplemental Security Income (SSI). |

| Retirement or pension Income | Yes | Include most IRA and 401k withdrawals. (See details on retirement income in the instructions for IRS publication 1040). Note:Don’t include qualified distributions from a designated Roth account as income. |

| Alimony | Yes | |

| Child support | No | |

| Capital gains | Yes | |

| Investment income | Yes | Include expected interest and dividends earned on investments, including tax-exempt interest. |

| Rental and royalty income | Yes | Use net rental and royalty income. |

| Excluded (untaxed) foreign income | Yes | |

| Gifts | No | |

| Supplemental Security Income (SSI) | No | But do include Social Security Disability Income (SSDI). |

| Veterans’ disability payments | No | |

| Worker’s Compensation | No | |

| Proceeds from loans (like student loans, home equity loans, or bank loans) | No |

All of the terms below are directly related to understanding how MAGI applies to the Affordable Care Act and cost assistance. Terms are defined further in the 8962 instructions.

Household income (Family income) = Household or family income for the ACA is MAGI of the head of household (and spouse if filing jointly) plus the AGI of anyone claimed as a dependent.

Federal Poverty = The ‘Federal Poverty Guidelines‘ show what percentage of the ‘Federal Poverty level’ a families household income puts them. They differ for Hawaii and Alaska. For the ACA the amount is based on MAGI, but MAGI is calculated slightly differently if you are applying it to Medicaid rather than the Marketplace. (See chart below for clarification.)

Premium Tax Credits = Premium tax credits are cost assistance for health insurance premiums. They can be taken in advance on any Marketplace plan and then claimed or adjusted using form 8962 at the end of the year.

Gross Income = Total income before deductions.

Adjusted Gross Income = Income adjusted for deductions.

Modified Adjusted Gross Income = Income adjusted for deductions, with certain income added back in (see full list below).

Modified adjusted gross income (MAGI) can be calculated using the calculations below. These are the official IRS instructions. Although we discuss simple ways of finding out your MAGI on this page, we suggest following the official instructions line-by-line for tax purposes.

If you are finding out MAGI for the tax credit, use the methodology below (as found on the 8962 instructions). If you need to calculate MAGI for Form 8582, use IRS MAGI calculator.

NOTE: I’ve done my best to reiterate what is said in the 8962 instructions to help you understand the part of the instructions you can use to find your MAGI, however our site while helpful is no replacement for the official instructions and/or the help of a tax professional!

Enter your modified AGI on line 2a. Use the worksheet below to figure your modified AGI from your tax return.

| 1. | Enter your adjusted gross income (AGI)* from Form 1040, line 7, or Form 1040NR, line 36 | 1. | |

| 2. | Enter any tax-exempt interest from Form 1040, line 2a, or Form 1040NR, line 9b | 2. | |

| 3. | Enter any amounts from Form 2555, lines 45 and 50, and Form 2555-EZ, line 18 | 3. | |

| 4. | Form 1040 filers: If line 5a is more than line 5b, subtract line 5b from line 5a and enter the result | 4. | |

| 5. | Add lines 1 through 4. Enter here and on Form 8962, line 2a | 5. | |

| *If you are filing Form 8814 and the amount on Form 8814, line 4, is more than $1,050, you must enter certain amounts from that form on Worksheet 1-2. See Form 8814 under Line 2b below. | |||

If the amount on line 6 of Worksheet 1-1 above is less than zero, seeLine 3, later, before you enter an amount on Form 8962, line 3.

Enter the modified AGI for all of your dependents on line 2b. Use the worksheet below to figure the combined modified AGI for the dependents claimed as exemptions on your return. Only include the modified AGI of those dependents who are required to file a return. Do not include the modified AGI of dependents who are filing a tax return only to claim a refund of tax withheld or estimated tax.

| 1. | Enter the AGI* for your dependents from Form 1040, line 7, and Form 1040NR, line 36 | 1. | |

| 2. | Enter any tax-exempt interest for your dependents from Form 1040, line 2a, and Form1040NR, line 9b | 2. | |

| 3. | Enter any amounts for your dependents from Form 2555, lines 45 and 50, and Form 2555-EZ, line 18 | 3. | |

| 4. | For each dependent filing Form 1040: If line 5a is more than line 5b, subtract line 5b from line 5a and enter the result | 4. | |

| 5. | Add lines 1 through 4. Enter here and on Form 8962, line 2b | 5. | |

| *Only include your dependents who are required to file an income tax return because their income meets the income tax return filing threshold. | |||

If the amount on line 6 of Worksheet 1-2 above is less than zero, see Line 3, later, before you enter an amount on Form 8962, line 3.

Often you will hear Annual Household Income or Family Income used in regards to the ACA. Typically, this is your MAGI plus the Adjusted Gross Incomes of all of your dependents who are required to file tax returns.

Modified AGI (MAGI) includes Adjusted Gross Income on your federal income tax return plus any excluded foreign income, nontaxable Social Security benefits (including tier 1 railroad retirement benefits), Supplemental Security Income (SSI), and tax-exempt interest received or accrued during the taxable year.

You won’t find MAGI on your 1040, but you will find Modified AGI on Form 8962, Premium Tax Credit (PTC), the form you use for reporting Marketplace cost assistance. If you are looking at past tax returns, look at Adjusted Gross Income (AGI) and take it from there. In most cases, it’s a similar amount.

MAGI, in most cases is simply your Adjusted Gross Income plus taxable interest found on lines 37 and 8b of your IRS from 1040. Take a look at the form. You’ll see big sections on Income and Adjusted Gross Income. If you don’t think your income will change, you can base everything on that information. See the full How to Calculate Modified Adjusted Gross Income (MAGI) video.

We cover MAGI on our subsidy calculator page, but since it’s so important to the ACA, we will do a detailed breakdown of MAGI and the other income types below.

FACT: When you apply for the Marketplace, all of your calculations will be done for you in regards to receiving cost assistance. That being said, knowing how all of this works will allow you to be certain that your cost assistance is right and will help you if you are filing your taxes by hand. By learning how to take advantage of tax deductions, you can save money both at tax season and when buying health insurance.

For the ACA, MAGI is used for:

Determining Marketplace Cost Assistance. You’ll use your projected MAGI for the upcoming year to figure out how much cost assistance (Tax Credits and Cost Sharing Subsidies) you are eligible for. Later, you’ll adjust that amount on your year-end taxes. This means that not understanding MAGI can result in you owing money on your taxes or not getting all the subsidies you are eligible for. Don’t forget to adjust info for life changes in the marketplace; this will help you avoid getting the wrong cost assistance.

NOTE: You’ll report income from members of your household on your application. The Marketplace excludes some income based on things, like the amount and type of income, the household member’s age and relationship to you, etc.

Determining if You Qualify for Medicaid or CHIP. Just like cost assistance, Medicaid and CHIP are based on MAGI. You can qualify based on past MAGI or future MAGI. However, both programs have other eligibility guidelines in states that didn’t expand Medicaid. Eligibility is based on your household size, income, and other factors (age and disability, for example).

Determining your percentage of the Federal Poverty Level. When you know your MAGI, it’s pretty simple to see where you stand on the Federal Poverty Level. The Federal Poverty Guidelines are used to determine both cost assistance and Medicaid / CHIP eligibility. They are also used for a ton of other assistance programs, many of which you might not even be aware you qualify for. Not all programs use MAGI, so keep this in mind when seeing what assistance you qualify for outside of ACA-related assistance. See our Federal Poverty Guideline page for details on all of this.

Figuring out if you will owe the Shared Responsibility Payment. If your Gross Income (Not MAGI) is below the filing threshold, you don’t have to make a Shared Responsibility Payment. That being said, some assistance programs use MAGI, so even if you won’t file, it’s worth understanding.

The information below is complied in part from our own work, HealthCare.Gov, Zane Benefits, IRS, and TurboTax. These are all reliable sources for exploring the ACA and MAGI that we feel confident in recommending.

Modified Adjusted Gross Income is a measure used by the IRS to determine if a taxpayer is eligible to use certain deductions, credits, or retirement plans. “Modified Adjusted Gross Income” (not “Adjusted Gross Income”) will be used in determining eligibility for your health insurance tax credits. The IRS phases out the tax credit as your income increases. By adding MAGI factors back to your AGI, the IRS determines how much you earned. Beginning in 2014, your MAGI determines your eligibility for both premium tax credits and Cost Assistance subsidies on the new Health Insurance Marketplaces.

Your Adjusted Gross Income (AGI) is your household’s income less various adjustments. Adjusted Gross Income is calculated before the itemized or standard deductions, exemptions, and credits are taken into account.

AGI is found on:

NOTE: 1040-A and 1040-EZ were both replaced by the resigned 1040 for the 2018 tax year.

NOTE: There are some specific dollar amounts below that have not been updated for 2019, for example the health savings deduction. Feel free to use this guide for reference, but do check the official documents for the latest dollar amounts below.

Your Modified Adjusted Gross Income (MAGI) is the total of your household’s Adjusted Gross Income and any tax-exempt interest income you may have.

Adjusted Gross Income (AGI, as defined by IRS)

+ Excluded foreign income

+ Tax-exempt interest

+ Non-taxable Social Security benefits

= MAGI

Let’s talk about what income is counted under MAGI. Since MAGI includes AGI, the list below comprises both MAGI and AGI. The list will help you understand which types of income do count toward deductions that affect HSAs and cost assistance and which types do not.

Income Counted Under MAGI:

Earned Income

Wages, salaries, tips

Self-employment, business and farm income after deduction of business expenses (including depreciation and capital losses)

Unearned Income

Interest (taxable and non-taxable)

Social Security (SSA) income

Dividends

Taxable state income tax refunds and credits

Portion of scholarships, awards or fellowship grants used for living expenses

Alimony received

Capital/other gains

IRA distributions (taxable amount only)

Pensions and annuities

Rental real estate income and royalties

Unemployment Compensation

Other income if taxable (such as prizes, jury duty pay not given to employer, etc.)

MAGI Income Deductions:

Business/Self-employment expenses, include:

farm expenses,

depreciation,

capital losses (limited to $3,000 in a tax year or $1,500 if married and filing separately),

rental/real estate losses,

partnership and S Corporations losses, and

royalties loss

Estate and trust loss

Educator expenses (limited to $250 per educator in a tax year)

Real estate mortgage investment loss

Business expenses of Reservists, Performing Artists, and Fee-Basis Government Officials

Health Savings Account Deduction (limited to $271/month for single filer, and $538/month for a family)

Moving Expenses (if you moved in connection with new job)

Tax deductible part of self-employment tax

Self-employed SEP, SIMPLE, and qualified plans

Self-employed health insurance deduction

Penalty on early withdrawal of savings

Alimony paid

IRA deduction

Student loan interest (limited to $2,500 in a tax year)

Tuition and fees (limited to $4,000 in a tax year)

Domestic production activities deduction (up to 9% of qualified production activities)

NOTE: For MAGI, alimony paid must be entered under the Miscellaneous Expense screen in the IES Worker Portal (for non-MAGI, you enter alimony paid on Support Expenses screen). IES does not track annual caps for MAGI income deductions. Workers must ensure that deductions that exceed the annual caps are not entered. For example, if a teacher reports $50 per month in educator expenses from January through June, the cap of $250 will have been reached by May. Do not allow the expense for the remaining months of the calendar year.

Income Deductions Not Considered Under MAGI:

The following income deductions will no longer apply to MAGI groups:

$90 employment deduction for employed persons

the $30 plus 1/3 earned income exemption (EIE)

child care expenses

child support that was paid to someone not in the household

Income Not Counted Under MAGI

Child support income received

Worker’s Compensation

Veteran’s Benefits

Supplemental Security Income (SSI)

Portion of scholarships, awards or fellowship grants used for qualifying education expenses

Native American and Alaska Native (AI/AN) income derived from distributions, payments, ownership interests, real property usage rights, and student financial assistance provided under the Bureau of Indian Affairs education programs.

This list of what is considered MAGI is from a TurboTax article on HSAs. Learn more about MAGI here or read the IRS’ explanation of MAGI.

Your gross income is the money you earned through wages, interests, dividends, rental and royalty income, capital gains, business income, farm income, unemployment, and alimony. This is the basis for your AGI calculation.

Gross income includes salary, interest earned, income from investments, and any income you made through business, trade, or investments.

Once you have gross income, you “adjust” it to calculate your AGI. You make adjustments by subtracting qualified deductions from your gross income.

Adjustments can include items like some contributions to IRAs, moving expenses, alimony paid, self-employment taxes, and student loan interest.

There are many free AGI calculators available online.

Once you have adjusted gross income, you “modify” it to calculate your MAGI. Specifically, Modified Adjusted Gross Income (MAGI) is calculated by adding back certain items to your Adjusted Gross Income including:

• Deductions for IRA contributions.

• Deductions for student loan interest or tuition.

• Excluded foreign income.

• Interest from EE (employee) savings bonds used to pay higher education expenses.

• Employer-paid adoption expenses.

For most people, MAGI is the same as AGI.

![]()

ObamaCare: Modified Adjusted Gross Income (MAGI)

Thomas DeMichele is the head writer and founder of ObamaCareFacts.com, FactsOnMedicare.com, and other websites. He has been in the health insurance and healthcare information field since 2012. ObamaCareFacts.com is a.

ObamaCareFacts is a free informational site. It's privately owned, and is not owned, operated, or endorsed by the US federal government or state governments. Our contributors have over a decade of experience writing about health insurance. However, we do not offer professional official legal, tax, or medical advice. See: Legal Information and Cookie Policy. For more on our company, learn About ObamaCareFacts.com or Contact us.